does unemployment reduce tax refund

The second wave will recalculate taxes owed by taxpayers who are married and filing jointly as well as individuals with more complicated. Tax Refunds on 2020 Unemployment Benefits Due to Begin This Month.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment compensation is not considered earned income for the Earned Income Tax Credit EITC childcare credit and the Additional Child Tax Credit calculations and can reduce the amount of credits you may have traditionally received.

. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Does unemployment reduce tax refund.

Unemployment refunds are scheduled to be processed in two separate waves. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. Those who have past-due debts including federal and state taxes child support and student loans unemployment will.

In good news for many taxpayers the IRS said that beginning in May and continuing through the summer it would automatically issue refunds to eligible people who already filed a tax return reporting unemployment compensation before the changes made by the American Rescue Plan Act PL. If Your Time is short. Unemployment Insurance UI benefits are taxable income but do not count as earnings.

Receiving unemployment benefits does not mean that a federal income tax refund will be reduced. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon. If you owe unemployment compensation to the state because the state believes that you were previously overpaid then yes the IRS can take part or all of your refund if the state asks.

But for many jobless workers and their families those payments come with a catch. Monday May 23 2022. They may result in smaller refunds from tax credits such as the earned income tax credit EITC next spring.

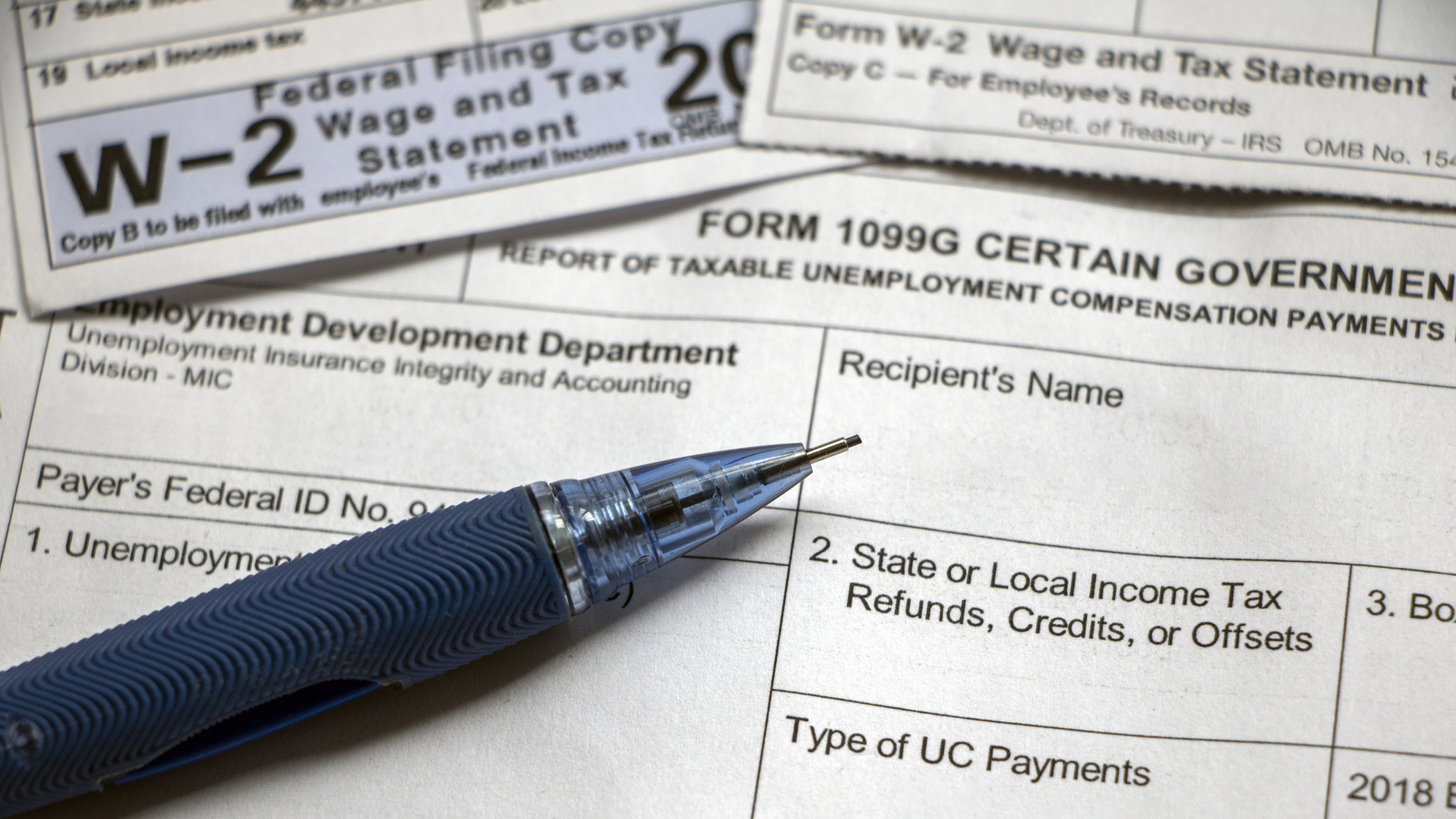

This is not the amount of the refund taxpayers will receive. You will need your social security number and the exact amount of the refund request as reported on your income tax return. As most people eligible for the break filed their tax returns before the act came.

A tax refund which occurs when a tax filer overpays their federal income. Unemployment Income Rules for Tax Year 2021. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits.

Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. WASHINGTON The Internal Revenue Service today reminded taxpayers how to avoid common errors on their tax returns. Not only that but in most cases taxes had not already been withheld from their unemployment checks meaning that their refunds would be reduced or they would have to pay up at tax time.

With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption. If you didnt have tax withheld from their unemployment payments or didnt have enough withheld in 2021 you may owe money to the IRS or get a. The second phase includes married couples who file a joint tax return according to the IRS.

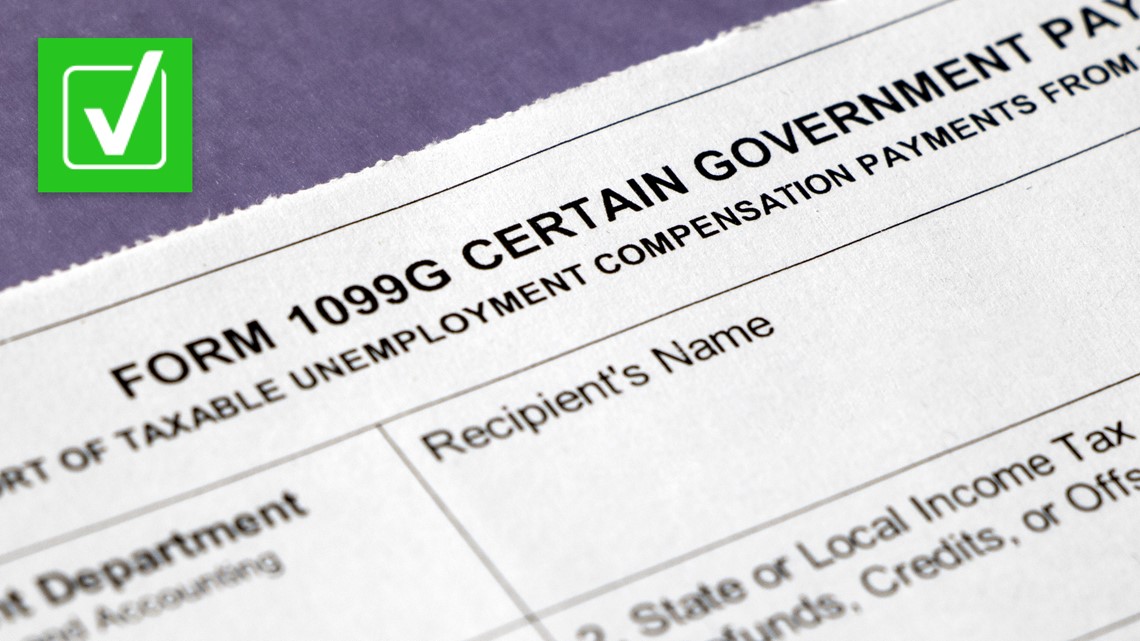

If you paid more than the correct tax amount the IRS will either refund the. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. The IRS will issue refunds in two phases.

Unemployment benefits are taxable. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. January 26 2022 158 PM.

IRS refunding taxes overpaid on unemployment benefits. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The 150000 income limit is the same whether you are filing single or married.

If the amount of unemployment repayment is more than 3000 calculate the tax under both of the following methods. The deduction is subject to the limit of 2 of your adjusted gross income AGI. If the amount of unemployment repayment is 3000 or less deduct it on Schedule A in the year you repaid.

If so how do I get notification this was done because my amount owed to me was less then what I was to get. People might get a refund if they filed their returns with the IRS before. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

This means that you dont have to pay federal tax on the first 10200 of your unemployment benefits if your adjusted gross income is less than 150000 in 2020. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Already filed a tax year 2020 tax return.

In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax. Tax Treatment of Unemployment Benefits. 1 Best answer.

Usually unemployment benefits are taxable but the act waived the tax due to the impact of the COVID-19 pandemic. It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. Unemployment benefits count as taxable income the unemployment income federal tax exemption does not include unemployment income for 2021.

Compare the results and use the method. Those rules changed however in March 2021well into the 2020 tax season after many had already filed their returns. This refund may also be applied to other taxes owed.

If both members of a married couple were receiving unemployment they could both deduct up to that amount. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. The government does not consider such tax refunds as income.

Couples can waive tax on up to 20400 of benefits. A large tax refund will not affect your unemployment benefits. In fact unemployed people often receive a larger than usual income tax refund as the payroll department calculates withholding based on an entire years pay so too much was taken out if you are subsequently laid off.

Can unemployment take money from federal refund.

Fillable Form 940 2018 Payroll Taxes Tax Forms Payroll

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

The Case For Forgiving Taxes On Pandemic Unemployment Aid

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

Sample Payroll Tax Form 940 Payroll Taxes Tax Forms Payroll

An Independent Contractor Is A Person Or Entity That Contracts With Another To Perform A Particular Task Business Tax Independent Contractor Education Poster

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Unemployment Taxes Will You Owe The Irs Credit Com

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com